How To Change Bank Account For Fafsa

You'll accept a better hazard at receiving coin for college if yous avoid several common mistakes when filling out yourFree Awarding for Federal Pupil Aid(FAFSA®) course, such as not completing it on time, non filling it out correctly, or forgetting to sign and submit.

1

We hear all kinds of reasons for not completing the FAFSA form: "The FAFSA course is too hard." "Information technology takes too long to complete the form." "I'll never qualify anyway, so why does it affair?" Itdoes matter. For i, contrary to popular belief, youmay qualify for federal educatee aid because it doesn't have an income cut-off. It takes into account factors like the size of your family and your year in school. Too, the FAFSA form is not simply the application for the Federal Pell Grant. It's also the awarding for Federal Piece of work-Study funds, federal educatee loans, and even scholarships and grants offered past your state, school, or a private organization.

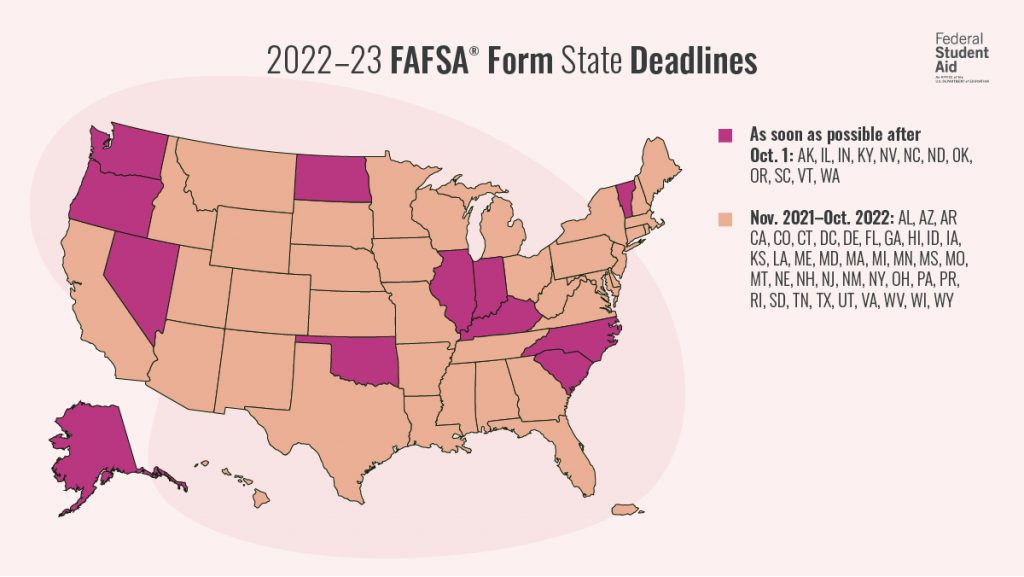

If you want to become the about financial assist possible, fill out the FAFSA course right away. Many states have limited funds, so they may take early FAFSA deadlines.

The FAFSA class doesn't take too much time to complete, and it includes help text for each question. Be certain to sign and submit!

Y'all could potentially miss out on thousands of dollars to help you pay for college if you don't consummate the FAFSA class on time.

2

You should fill out the FAFSA form equally soon as possible, just you should DEFINITELY fill it out before your earliest FAFSA deadline. Each country and school sets its ain deadline, and some are very early.

3

Information technology'due south important to get a StudentAid.gov account username and password (FSA ID) before filling out the FAFSA form. Why? When yous register for an FSA ID, you may need to expect up to iii days earlier you lot can utilise information technology to sign your FAFSA form electronically. You AND your parent (if y'all're considered a dependent student) will each need your own separate FSA IDs to sign the FAFSA form online or on the mobile app. Exercise NOT share your FSA IDs with each other! Doing so could cause bug or delays with your financial assist. Don't wait!

4

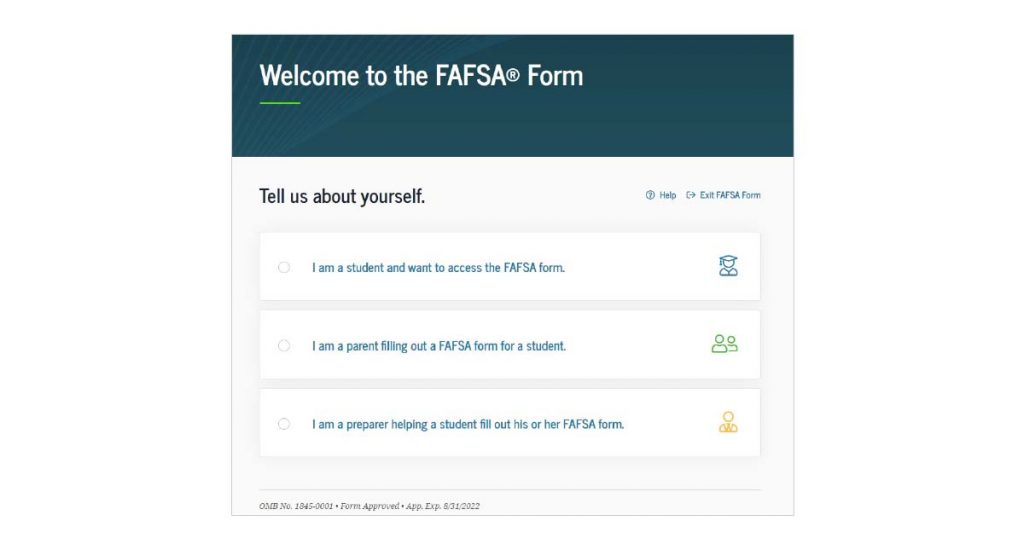

When you begin your FAFSA form, y'all volition need to identify yourself equally one of the following:

- I am the educatee

- I am a parent

- I am a preparer

If you're the student, y'all should choose the beginning option. Why? When you lot practise, some of your personal information (name, Social Security number [SSN], date of birth, etc.) will automatically load into your application. This will prevent you from running into a mutual error that occurs when your verified FSA ID information doesn't lucifer the information on your FAFSA form. Also, you won't take to enter your FSA ID again if yous transfer your tax information from the IRS or sign your FAFSA class electronically.

5

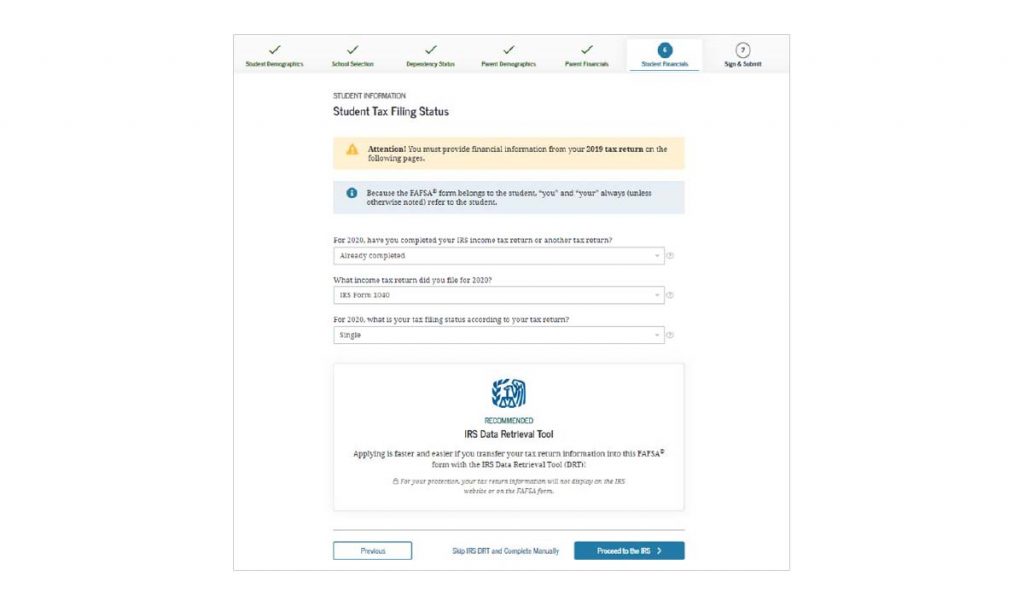

One of most difficult parts about filling out the FAFSA course is entering the financial information. But thanks to a partnership with the IRS, students and parents who are eligible can automatically transfer necessary 2020 tax information into the 2022–23 FAFSA class using the IRS DRT. It's the fastest, nearly accurate way to enter your tax render information into the FAFSA form, so if yous're given the pick to "LINK TO IRS" button, take advantage of information technology!

6

When it comes to completing the FAFSA form, you'll want to read each definition and each question carefully; sometimes the FAFSA class is looking for very specific information that may non be obvious.

Here are some items that take very specific (merely non necessarily intuitive) definitions co-ordinate to the FAFSA form:

- Legal guardianship

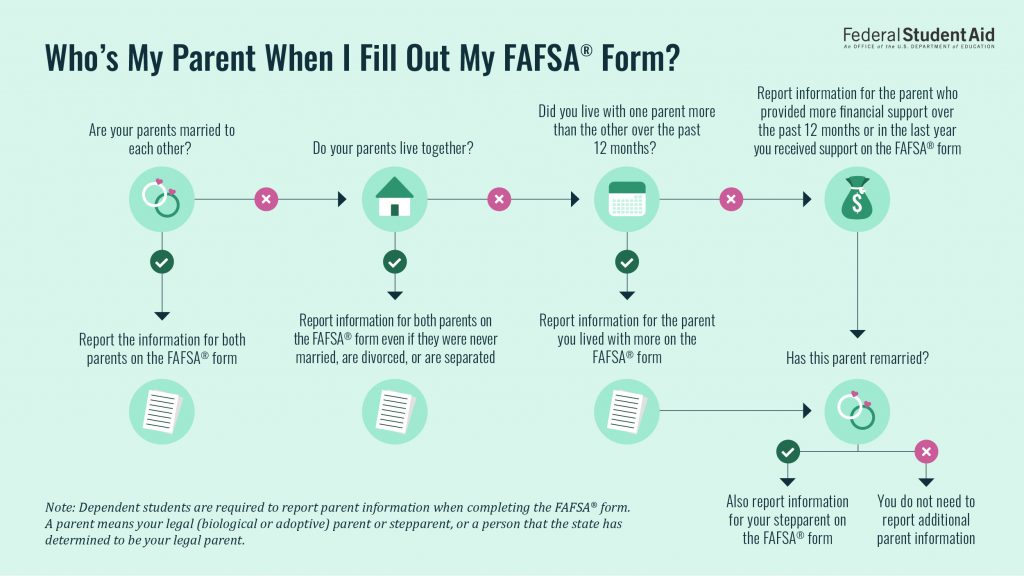

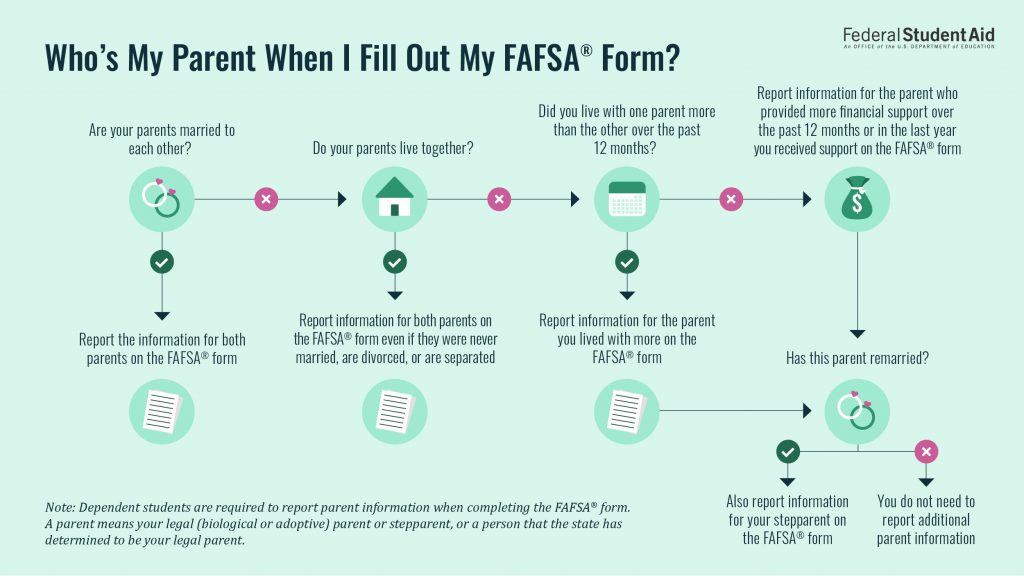

To determine your dependency status, the FAFSA form asks, "Does someone other than your parent or stepparent have legal guardianship of y'all, as determined by a court in your state of legal residence?" Many students incorrectly answer "aye" here. For this question, the definition of legal guardianship does not include your parents—fifty-fifty if they were appointed by a court to be your guardians. Also, you lot cannot be your ain legal guardian. - Parents

The FAFSA class hasvery specific guidelinesabout which parent's data to report.Spoiler alert: Information technology has cipher to practice with who claims y'all on their taxes. The FAFSA form may enquire, "As of today, what is the marital status of your parents?" You can use this guide to help you effigy out which parent to report on the FAFSA form.

- Number of family members (household size)

The FAFSA form has a specific definition regarding how yous should determine your family unit size. Read the instructions carefully. Many students incorrectly study this number, especially when the educatee doesn't physically live with their parent. - Number of family unit members in college

Enter the number of people in your (or your parents') household who will attend college at the aforementioned time as you. Don't forget to include yourself, simply don't include your parents in this number, even if they're in college. This number should never be greater than your number of family members. - Net worth of investments

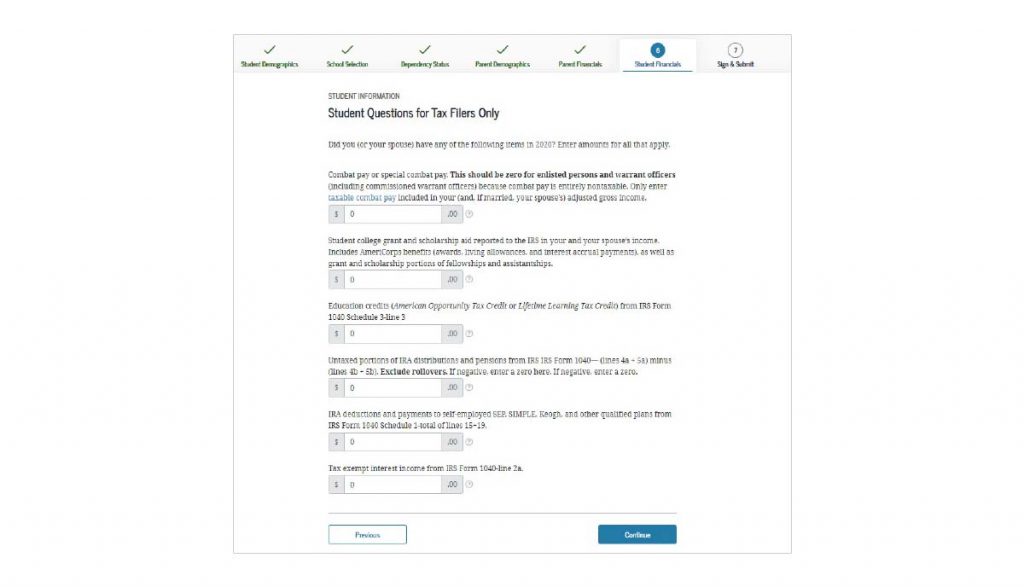

We've outlined some specific items that should and shouldn't exist included as investments on the FAFSA course. For case, a college savings plan like a 529 account is considered an investment* while the value of the habitation in which y'all reside and the value of your retirement accounts are not. - Taxable college grants and scholarships

For this question, you written report merely college grant and scholarship amountsreported to the IRS equally income. That means yous should not apply the corporeality listed on your 1098-T; you should study the amount listed on your tax return. Practice not utilise the number in the adjusted gross income (AGI) field. Here are the tax line numbers you should reference when asked this question. If y'all didn't file taxes, you should enter goose egg.

* If you lot're a dependent student, you should written report the value of whatever college savings accounts as a parent nugget and not a pupil asset.

7

Here are some examples of common errors nosotros see when people complete the FAFSA® form:

- Disruptive parent information with pupil information

We know many parents will fill out the FAFSA form for their children, only recall, it is the educatee's application. When the FAFSA form says "you" or "your," it's referring to the educatee, so make sure to enter your (the student's) data. If the form is asking for your parent's data, it will specify that in the question. - Inbound data that doesn't match your FSA ID information

Later on you create an FSA ID, the Social Security Assistants receives and verifies your information (proper noun, SSN, date of birth). If you enter a different name, SSN, and/or date of nativity on the FAFSA form, you lot'll receive an error bulletin. This is often the upshot of either a typo or mixing up educatee data and parent information. Avoid delays by triple-checking the information you entered. If you encounter an error indicating that the information is not matching, learn how you can resolve the mistake. - Amount of your income tax

The FAFSA form is asking for your assessed income revenue enhancement liability, not the amount of income revenue enhancement withheld and not your adjusted gross income. We know this can exist complicated. To avert this mutual error, either transfer your tax data to the FAFSA form using the IRS DRT or discover out which tax line number you should refer to when answering this question. (Notation: Information technology volition depend on which IRS course yous filed.)

8

- Parent information

Even if yous fully support yourself, pay your own bills, and file your own taxes, you may nonetheless exist considered a dependent educatee for federal educatee assist purposes. If so, yous must provide parent data on your FAFSA® grade. Dependency guidelines for the FAFSA grade are determined by the U.S. Congress. They are different from the IRS dependency guidelines. Find out whether you need to provide parent data by answering these questions. If y'all're considered a dependent student and don't provide parent information, we may non process your FAFSA grade and/or y'all may qualify for unsubsidized loans only.

- Additional financial information

If you follow our recommendation and use the IRS DRT, most of the financial data required on the FAFSA form volition be filled in automatically for y'all. Nonetheless, the IRS DRT doesn't populate everything; some numbers, including many items in the "Additional Fiscal Information" section, must be manually entered. If you used the IRS DRT, you'll run across that some boxes in that section are prechecked and the fields prefilled with "Transferred from the IRS." Withal, other items, such as "Payments to revenue enhancement-deferred pension and retirement savings plans" and others, cannot transfer from the IRS. Y'all must review manually each item in the list, select the box if information technology applies to yous, and enter the appropriate amount by referencing your relevant financial records. In the instance of payments to tax-deferred pension and retirement savings plans, you can find that information on your Due west-2 form.

nine

Unless yous're applying to only 1 college or already know where you're going to school, you lot should include more than 1. Colleges can't come across the other schools you've added, so you should add ALL colleges yous are considering to your FAFSA® form, even if you aren't sure whether you'll utilise or be accustomed. You can add up to 10 schools at a time. If you're applying to more than 10 schools, follow these steps.

It doesn't hurt your application to add more schools. In fact, you don't fifty-fifty take to remove schools in which you lot decide non to use. If yous don't end up applying or getting accepted to a school, the school can but condone your FAFSA grade. Still, y'all can remove schools at whatsoever time to make room for new schools.

Note: If you're a resident of certain states, the lodge in which you list the schools on your FAFSA form might affair. Find out whether your state has a requirement for the order you lot list schools on your FAFSA form.

x

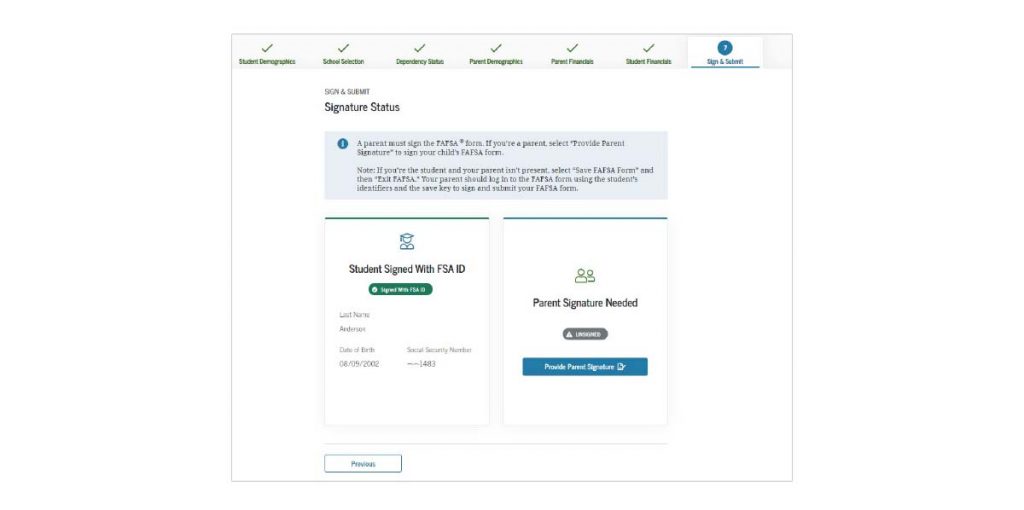

So many students answer every single question asked but fail to sign the FAFSA® form with their FSA ID and submit the grade. This happens for many reasons—mayhap y'all forgot your FSA ID or your parent isn't with you to sign with the parent FSA ID—and then your application is left incomplete.

Don't allow this happen to you.

- If y'all don't know your FSA ID, select "Forgot My Username" and/or "Forgot My Password."

- If yous don't have an FSA ID, create i.

If you're not able to sign with your FSA ID, take advantage of the option to mail a signature page. If you would like confirmation of your FAFSA course submission, you lot can bank check your status immediately after you submit your FAFSA form online.

Source: https://studentaid.gov/articles/10-fafsa-mistakes-to-avoid/

Posted by: fifeabloome.blogspot.com

0 Response to "How To Change Bank Account For Fafsa"

Post a Comment